From time to time, your Tidewater Consulting team will share information via our blogs. These short, informative posts are designed to answer common questions, share relevant industry trends, and to strengthen and encourage the communities that we serve. The knowledge that is expressed in these posts represents 35 years of practical experience in medical / dental billing and coding, compliance, and administration of insurance. If there is a topic or issue you’d like us to consider please contact us.

Welcome to the blog

Whether to bill for local anesthesia in conjunction with dental procedures requires careful consideration, particularly in light of coding guidelines and payer policies. Understanding the nuances of the CDT (Current Dental Terminology) language, ethical billing practices, and payer requirements is essential for maintaining compliance and avoiding potential issues.

CDT Language – Local Anesthesia Billing

Every code set used in healthcare to document dental and medical procedures and diagnoses contains guidelines that must be followed to ensure an accurate population of the patient’s health records and ethical and compliant billing practices. One such guideline of CDT is reporting local anesthesia as a separate procedure in addition to the dental procedure rendered. A guideline found at the beginning of the Restorative category states, “Local anesthesia is usually considered to be part of Restorative procedure.” This language regarding local anesthesia is also found in the following categories: Endodontics, Periodontics, Prosthodontics (Removable), Implant Services, Prosthodontics, fixed, and Oral & Maxillofacial Surgery.

This term, “usually,” serves as a coding guideline and underscores that there are instances where billing for anesthesia may be appropriate. However, routine billing for local anesthesia in all circumstances does not align with coding guidelines or best billing practices and can raise compliance concerns.

To determine whether billing for anesthesia is justified, one must review applicable payer policies carefully. Insurance plans typically consider local anesthesia inclusive and integral to the procedure. Thus, submitting anesthesia as a separate billing item in such cases could be inappropriate. Dental professionals are encouraged to thoroughly assess the circumstances under which they believe billing for anesthesia is warranted and clearly document the reasons.

When Billing for Local Anesthesia May Be Appropriate

While most routine procedures, such as fillings, do not warrant separate billing for local anesthesia, there are exceptions where it may be appropriate and justified. For example:

A patient presents with significant decay requiring operative treatment. During excavation, it is discovered that the tooth is fractured, or the pulp is exposed. The dentist administers a long-acting anesthetic to manage the pain and ensure patient comfort until they can visit a specialist later the same day.

Another scenario involves emergency cases where pain control is necessary:

A patient arrives at the dental office in severe pain, requiring immediate attention. The treating dentist administers local anesthesia to numb the affected area for pain relief. This intervention can serve two purposes— to stabilize the patient until they can be referred to a specialist or to assist in the diagnostic process by allowing a thorough examination without the hindrance of acute discomfort.

These examples highlight situations that go beyond routine care, where the administration of local anesthesia is clinically justified. The key here is clear documentation—detailing both the condition of the tooth or the patient’s situation and the reasoning for additional anesthetic administration under these exceptional circumstances.

There are two available CDT codes to consider when the treating provider determines that billing for local anesthesia is appropriate for a particular patient and is specific to their documented condition and circumstance. The codes are:

D9210 local anesthesia not in conjunction with operative or surgical procedures

D9215 local anesthesia in conjunction with operative or surgical procedures

Why Routine Billing for Anesthesia Is Problematic

Routinely billing for local anesthesia in cases where it is typically included as part of the procedure carries several risks:

- Non-Compliance with Payer Policies

If an insurance plan explicitly states that local anesthesia is inclusive, submitting anesthesia as a separate procedure could result in billing discrepancies or even allegations of improper billing practices. - Audits and Potential Consequences

Improper billing increases the likelihood of payer audits, which can uncover patterns of routine claims inconsistent with the plan’s provision. This scrutiny could lead to claim denials, repayment demands, or more serious actions. - Professional Integrity

Ethical billing practices are foundational to maintaining trust and professionalism in the dental field. Routinely billing for services typically included in the code and fee erodes that trust and risks reputational harm.

Best Practices for Billing Local Anesthesia

To ensure compliance and align with ethical practices, consider the following recommendations:

- Know Your Payer Policies: Invest time in understanding the specific requirements of the insurance carriers you work with. If in doubt, contact the payer for clarification.

- Document Thoroughly: When billing for local anesthesia separately, provide detailed clinical notes justifying its necessity. Include information on the patient’s condition and why administering additional anesthesia was required.

- Avoid Routine Billing: Establish clear internal policies discouraging routine billing for anesthesia when it is typically included as part of the procedure. Educate your staff to identify and report situations where billing may apply.

- Align with CDT Guidelines: Follow CDT language precisely, which specifies that anesthesia is “usually” considered inclusive but allows for flexibility when circumstances diverge from the norm.

Final Thoughts

Billing for local anesthesia separately from dental procedures must be approached with care, professionalism, and adherence to established guidelines. While there are specific situations where it is appropriate to bill for anesthesia, such instances are exceptions—not the rule. Understanding coding guidelines, payer policies, and documenting the clinical necessity of services are critical steps to ensure ethical and compliant billing practices. Adopting a cautious and precise approach to billing benefits the dental practice and the trust and care patients place in their providers.

Disclaimers:

The information presented is intended for educational and training purposes only. It is not intended to be legal advice. Always seek the advice of an attorney for legal-related questions regarding proper coding and billing practices.

The information presented has been researched by the author and is current as of the publishing date of this article. CDT codes are updated annually and effective on January 1 of each year. Invest in current coding manuals and training for your entire team on an annual basis to ensure proper documentation, coding, and billing practices.

The Code on Dental Procedures and Nomenclature is published in CDT 2025: Current Dental Terminology, Copyright © 2024 American Dental Association (ADA). All rights reserved. ADA is the exclusive copyright owner of CDT, the Code on Dental Procedures and Nomenclature (CDT Code), and the ADA Dental Claim Form.

Copyright ©2025 Tidewater Consulting Services, LLC. All rights reserved.

Read More

The short answer to this question is, sometimes. Since the announcement of the revision of the ADA Dental Claim form effective January 1, 2024, there have been a lot of assumptions made, and yes, at times, you may have received misleading information. This article will address the 2024 claim form and the requirement to append diagnosis codes using the ICD-10-CM code set. I hope this article will clarify what diagnosis codes are and when they may be applicable.

What are diagnosis codes?

Diagnosis codes communicate a diagnosis, condition, symptoms, and procedures across healthcare systems and track diseases and morbidity. This is not medical coding, despite what you may have heard in the past few years. It is simply another code set that serves a different purpose than Current Dental Terminology (CDT), which we are most familiar with in dentistry. In dentistry, historically, we have communicated symptoms, diagnoses, or conditions treated in the form of a wordy written narrative entered in the remarks section of the ADA Dental Claim Form. A code can be applied to the claim form instead of using a written narrative to describe what condition is being treated. A diagnosis code proves and establishes medical or dental necessity. For many years, at least one diagnosis code has been required for medical claims.

Brief History of ICD-10 Code Set in the United States

ICD is the acronym for the International Classification of Diseases. In the U.S., we utilize two ICD code sets, clinical modification (CM) and Procedure Coding Systems (PCS). A dentist will not use an ICD-10-PCS code. The PCS set is strictly used by facilities such as hospitals and reports inpatient procedures. Even if the dentist treats a patient in a hospital, she will select a code from the ICD-10-CM code set.

In 2008, the U.S. Department of Health and Human Services (HHS) issued a proposed rule to transition from ICD-9 to ICD-10 on October 1, 2011. At the time, ICD-9 was 35 years old and outdated. Many physicians and other healthcare stakeholders expressed that time was needed for the transition. So, in the 2009 final rule, HHS established October 1, 2013, as the date for the transition to give U.S. healthcare providers two additional years to prepare.

In 2012, as part of President Obama’s commitment to reducing regulatory burden, HHS moved the implementation of the ICD-10 date to October 1, 2014, providing the industry with an additional year to work toward a successful transition. As healthcare providers diligently prepared for implementation, it was delayed until October 1, 2015. The Protecting Access to Medicare Act of 2014 (PAMA), enacted on April 1, 2014, prohibited the HHS Secretary from adopting ICD-10 before October 1, 2015. The ICD-10 code set became effective for all dates of services beginning October 1, 2015.

ICD-10 includes thousands more codes than ICD-9, allowing for greater specificity. Was it a learning curve for the entire healthcare industry, including dentists? Yes, absolutely, it was.

How does documentation come into play?

Like our CDT code set, which we use to document dental procedures performed and report to third-party payers, only what is documented can be reported. I recall attending my first ICD-10 workshop in 2014. The workshop topic was teaching healthcare providers how to document for ICD-10. Wow, was that an enlightening workshop! It was in that seminar that I realized our clinical documentation in dentistry was significantly lacking. I knew we needed to start teaching how to document with greater specificity. Teaching the importance of documentation began in 2014, and I’ve continued teaching since then.

As much as I love dentists and have many friends who are dentists, I can say lovingly that they are not historically known for their thoroughness in documentation like our medical doctors. Lack of specificity in documentation remains our number one root cause for claims denials, reimbursement delays, and audit outcomes. Proving a dental procedure is medically necessary has not been something we focused on in dentistry until now. We must improve and include greater specificity in our clinical documentation. Everyone on the dental team is responsible for ensuring accuracy in documentation.

Are the diagnosis code fields new to the claim form?

No, these are not new fields on the 2024 ADA Dental Claim Form. Looking back to 2011, the ADA Dental Claim Form 2006 version was revised, including adding the fields 29a, 34, and 34a, where we enter ICD-10-CM code information. This new version became effective January 1, 2012.

While at the time of the revision to the 2012 ADA Dental Claim Form, adding these diagnosis code fields, there was no confirmation from any state or federally funded programs as to when this would be required. There was discussion among some state Medicaid programs that they would require the application of diagnosis codes on dental claims in 2014, but there was no confirmation of this. However, the ADA was forward-thinking, considering the implementation of the Affordable Care Act on January 1, 2014, and ICD-10, which was initially scheduled to be implemented on October 1, 2014.

Why state and federally funded programs?

We’ve already learned that data regarding diseases and morbidity is gathered from applying ICD codes on claims. State and federally funded programs also use diagnosis codes to determine what we, as healthcare providers, do to prevent diseases. In other words, are we screening for disease, thus taking measures in disease prevention?

In the spring of 2014, I received a call from the executive director of the Southern Nevada Dental Association asking for help teaching dental Medicaid providers how to apply diagnosis codes to the dental claim form. Nevada was the first state Medicaid program I was aware of requiring the application of diagnosis codes on ALL dental claims. These providers were not being paid by Medicaid due to the omission of diagnosis codes. Our work was cut out for us, and we were up for the challenge.

I had just begun working alongside Dr. Charles Blair a few months before receiving this call regarding the problem dentists were facing in Nevada. Dr. Blair, myself, and my colleague, Glenda Hood, CPC, put our heads together on how to teach diagnosis coding to dental teams. Dr. Blair and I combined our dental knowledge with Glenda’s 30+ years of medical coding and billing experience. We set out to create a resource quickly, as these dentists were not being paid and needed to be paid.

Due to the delayed implementation of ICD-10 in 2015, these Nevada dentists had to learn ICD-9 and ICD-10. Glenda and I had the idea we would create a 25-page reference guide they could keep in their desk drawer. The three of us decided that clinical scenarios would be the best way to teach this new concept. We quickly began to write clinical scenarios, research appropriate codes, and design an easy to use publication. I might add that the original design was completed using Microsoft Word, not fancy software, as we needed to get this resource to dentists as quickly as possible. In true Dr. Blair style, that 25-page reference guide promptly expanded into a 250 page book with chapters on navigating Medicaid. We got our designer, Margaret Macknelly, and the entire PracticeBooster team involved, and in the fall of 2014, the first edition of “Diagnostic Coding for Dental Claim Submission” 2015 edition was released. Dr. Blair’s Scenario-Based Teaching Method™ was released.

Fun Fact! When I resigned from Dr. Charles Blair and PracticeBooster, Dr. Blair gifted me with the original cover designs and book design started in Word, which I will always cherish. We spent many hours, evenings, weekends, early mornings, and even as I was riding in the car on vacation or on a plane, developing this resource, along with some great laughs and maybe a few tears – great memories were made.

Since then, many more state Medicaid programs have implemented the requirement to apply diagnosis codes to the ADA Dental Claim. Another fun fact, Glenda and I kept a white board and would add states and plans with the diagnosis code reporting requirement as we were able to confirm the information. Dr. Blair would come to our office after traveling to check the white board every Monday morning to see if we had added to the list. He would be so excited and as he used to say, “girls, we’ve hit a home run with this book!” Dr. Blair would be so excited and his heart fulfilled with every publication whether it be a single article or book knowing another dentist or dental team had a resource to help navigate their challenge.

Additionally, some dental plans have implemented the requirement of ICD-10-CM codes on dental claims. These plans include but are not limited to the Affordable Care Act medical plans with federally mandated pediatric preventive dental benefits, Medicare Advantage plans, and some plans that require a diagnosis code for specific procedures such as bone grafting. The requirement to apply diagnosis codes on dental claims is plan-specific and may sometimes be payer-specific. We have seen a steady increase in plan requirements since 2014 and expect this trend to continue.

While you may not be aware of a requirement to apply a diagnosis code to a dental claim, there may be times when you gave up on getting a claim processed, such as an ACA medical plan claim. Failure to apply diagnosis codes may have been the reason for claim rejection. I see this often.

So, what about the 2024 ADA Dental Claim Form changes? Yes, there were changes, and they were great ones, in my opinion. To learn more about these revisions, read my blog article here.

Another myth I am hearing is that effective May 1, diagnosis codes are required on the ADA Dental Claim Form. At least one dental payer I know of sent a letter to providers stating that effective May 1, 2024, if the claim was not submitted using the 2024 ADA Dental Claim Form, then your claim would be rejected. You see, a clean claim begins with the current claim form. A clean claim must be submitted to a payer, whether a medical or dental payer, to be adjudicated or processed. While most payers will grant a grace period and continue to accept the 2019 ADA Dental Claim Form, don’t be surprised if your claim is rejected in the near future if not submitted using the 2024 ADA Dental Claim Form. To be clear, just because a payer may require submission of claims using the 2024 ADA Dental Claim Form does not mean the payer requires application of ICD-10-CM codes. Contact your software vendor and clearing house to inquire about their readiness to implement the 2024 claim form for a smooth transition. Some practice management software may not be ready to implement the 2024 ADA Dental Claim Form. Your software support team can assist you in updating to the most current form.

In Conclusion

How can you best be prepared? Evaluate your documentation and improve on it. While you may not be required to submit a diagnosis code with your dental claim yet, we are held accountable for the same level of specificity in our documentation as if we are. Specificity in our clinical documentation is crucial, whether in a payer audit, court of law or claims adjudication. We must prove medical necessity –why a procedure is required. Let’s face it, patients don’t just drop in to see us and bring us brownies; they come for a reason, even for routine preventive dental care – and there is a code for that!

While we have discussed reimbursement in this article, it is not always about the reimbursement. It is about ensuring quality patient care. We do this by reporting ICD-10 codes along with our documentation. Be proactive and prepare for the need to apply a diagnosis code by reviewing your clinical documentation for specificity, implementing internal documentation audits involving your team, investing in education, and developing policies and procedures to ensure accuracy in documentation and reporting. As with all code sets, only what is documented can be reported! Documentation is key! If you want to learn more about diagnosis coding, join one of our workshops soon or reach out to inquire about our customized training for you and your team.

Read More

Did you know that all medical and dental plans include a clause prohibiting a doctor from submitting an insurance claim requesting reimbursement for professional services provided to an immediate family member? Yes, it is true. Let’s dive into what this means and why this is the case and discuss a real-life scenario.

The Cost of Misunderstanding

A few years ago, I received a consulting call from a dentist who had received a refund request from a dental payer. This payer requested all of the monies paid to her practice for the past three years for services performed on her sister. Her question was, can they really do this? The answer is yes, they can. This is called the familial relation clause or family exclusion clause. After I explained this to her, I later received a call from her sister, who questioned my explanation.

The dentist’s sister was a physician at a local hospital, which was a self-funded plan. We will refer to the physician as Dr. S. Dr. S quickly told me that she had reviewed her plan document, and this clause was not in her document. So, while I had her on the phone, I asked if she could email the plan document to me, and she did. I showed her this clause on page one of her dental plan document. The clause stated this:

“Coverage is excluded for care or services from a provider in a subscriber or patient’s immediate family.” It defined immediate family members as “immediate family or immediate family of spouse” or “enrollee’s spouse, child, brother, sister, or parent.”

So, in the end, Dr. C, the dentist, returned several thousand dollars to the payer for reimbursement for dental treatment provided for Dr. S, her sister, over three years. In addition, Dr. C violated her state law prohibiting copayment and deductible forgiveness, and her dental PPO contract prohibited forgiveness of a patient’s copayment or deductible provision, as the applicable copayments and deductibles were not collected. This was also a misrepresentation of the actual fee charged for the service, resulting in overbilling the insurance plan, a potentially fraudulent billing practice.

The Legal Framework: Understanding the Insurance Contract

Since that time, I have reviewed multiple medical and dental plan documents. Each plan will define an immediate family member, and the definition of an immediate family varies according to the plan. Another example of how a plan may define an immediate family member as part of the benefit exclusion is:

“a person who lives in the covered person’s home or who is related to the covered person by blood or marriage”

CMS Guidelines on Family-Related Exclusions

Let’s examine what the Centers for Medicaid and Medicare Services (CMS) says about his topic.

“130 – Charges Imposed by Immediate Relatives of the Patient or Members of the Patient’s Household (Rev. 1, 10-01-03) A3-3161, HO-260.12, B3-2332

A. General These are expenses that constitute charges by immediate relatives of the beneficiary or by members of their household. The intent of this exclusion is to bar Medicare payment for items and services that would ordinarily be furnished gratuitously because of the relationship of the beneficiary to the person imposing the charge. This exclusion applies to items and services rendered by providers to immediate relatives of the owner(s) of the provider. It also applies to services rendered by physicians to their immediate relatives and items furnished by suppliers to immediate relatives of the owner(s) of the supplier.

B. Immediate Relative The following degrees of relationship are included within the definition of immediate relative.

- Husband and wife;

- Natural or adoptive parent, child, and sibling;

- Stepparent, stepchild, stepbrother, and stepsister;

- Father-in-law, mother-in-law, son-in-law, daughter-in-law, brother-in-law, and sister-in-law;

- Grandparent and grandchild; and

- Spouse of grandparent and grandchild.

NOTE 1: A brother-in-law or sister-in-law relationship does not exist between the physician, supplier or owner of a provider (or supplier) and the spouse of his wife’s or her husband’s brother or sister.

NOTE 2: A father-in-law or mother-in-law relationship does not exist between a physician or the owner of a provider and his or her spouse’s stepfather or stepmother. A step-relationship and an in-law relationship continues to exist even if the marriage upon which the relationship is based is terminated through divorce or through the death of one of the parties. For example, if a provider treats the stepfather of the owner after the death of the owner’s natural mother or after the owner’s stepfather and natural mother are divorced, or if the provider treats the owner’s father-in-law or mother-in-law after the death of their spouse, the services are considered to have been furnished to an immediate relative, and therefore, are excluded from coverage.”

Source: Centers for Medicaid and Medicare Services (CMS)

https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/downloads/bp102c16.pdf

Why is this? In simple terms, any time a provider, whether the treating provider, owner of the practice, or any other relationship to the practice where there is potential financial gain from insurance benefits, this type of billing practice is inappropriate and not allowed. This includes an associate dentist who supervises the hygiene services rendered to his spouse, child, or other immediate family members. Most of us treat our immediate family members in our dental practices when services are rendered by another doctor or team member, such as a hygienist. Still, no claim should be filed for reimbursement.

I am often asked, “Well, I have a business to run; what do I do?” My response to a young dentist, new practice owner, was this – “Thanks, Mom and Dad, for supporting me through dental school. I am happy to provide your dental care for free as my thanks to you. Please consider referring your friends to me.”

The Ethical Dilemma of Treating Family Members

There is also an ethical piece to this puzzle. The American Medical Association says this about treating family and friends.

“When the patient is an immediate family member, the physician’s personal feelings may unduly influence his or her professional medical judgment. Or the physician may fail to probe sensitive areas when taking the medical history or to perform intimate parts of the physical examination. Physicians may feel obligated to provide care for family members despite feeling uncomfortable doing so. They may also be inclined to treat problems that are beyond their expertise or training.

Similarly, patients may feel uncomfortable receiving care from a family member. A patient may be reluctant to disclose sensitive information or undergo an intimate examination when the physician is an immediate family member. This discomfort may particularly be the case when the patient is a minor child, who may not feel free to refuse care from a parent.

In general, physicians should not treat themselves or members of their own families. However, it may be acceptable to do so in limited circumstances:

- In emergency settings or isolated settings where there is no other qualified physician available. In such situations, physicians should not hesitate to treat themselves or family members until another physician becomes available.

- For short-term, minor problems.

When treating self or family members, physicians have a further responsibility to:

- Document treatment or care provided and convey relevant information to the patient’s primary care physician.

- Recognize that if tensions develop in the professional relationship with a family member, perhaps as a result of a negative medical outcome, such difficulties may be carried over into the family member’s personal relationship with the physician.

- Avoid providing sensitive or intimate care especially for a minor patient who is uncomfortable being treated by a family member.

- Recognize that family members may be reluctant to state their preference for another physician or decline a recommendation for fear of offending the physician.”

Source: AMA Code of Medical Ethics, chapter 1 Patient-Physician Relationships

https://code-medical-ethics.ama-assn.org/chapters/patient-physician-relationships

Navigating Compliance: Practical Advice for Practitioners

Am I the only one who didn’t know this? Absolutely not. We have not had formal training on insurance-related topics in dentistry until recent years. There were also limited resources available. We only know what someone else told her before us or what we figured out on our own. This includes me. I worked in a dental practice before I began my consulting career 10 years ago. I experienced this in our practice. My doctor had been treating his son, daughter-in-law, and grandchildren for many years and began filing claims for their hygiene services. It was not long before the dental payer made the family connection and requested refunds for all services reimbursed for the previous six years since he began submitting claims. He did not violate state copayment or deductible forgiveness laws because the plan paid 100% of the charges submitted, nor was he in-network. Still, he gained financially from his son’s employer’s dental benefit plan.

Balancing Professional Ethics and Legal Obligations

Take the knowledge learned today, write a billing process to ensure compliance, and place it in your administrative standard operating procedure manual (SOP) – we all have one, right? If not, this is an excellent starting place to develop your administrative SOP manual. Train your team, document the training, and include this in your team onboarding training program. It can happen to you regardless of the type of plan – federal, self-funded, or fully insured, regardless of PPO participation.

Legal Disclaimer: The information presented is only intended for educational and training purposes. It is not intended to be legal advice. The author is not a licensed attorney. For definitive answers to legal-related questions, consult with an attorney knowledgeable of federal and state healthcare laws.

©2024 Tidewater Consulting Services, LLC

Read More

Understanding the concept of a benefit reserve is crucial for dentists and dental team members who handle insurance claims. While this term is commonly applied to fully insured plans, it can also apply to self-funded and federal plans. In this article, we will dive into the specifics of a benefits reserve, its purpose, and how it impacts dental insurance claims.

A benefits reserve, sometimes known as a credit reserve or COB (Coordination of Benefits) savings bank, comes into play when a secondary plan saves money on claims due to primary coverage being in place. State laws regulating insurance may require these savings to be recorded as a benefit reserve. The purpose of this reserve is to allow the plan to utilize the saved funds to cover allowable expenses that would otherwise remain unpaid during the plan year.

Let’s consider an example to illustrate this concept. Suppose a patient has reached their annual maximum coverage under the primary plan, and additional benefits are required for further treatments. In such cases, the benefit reserve funds can cover these extra expenses. These funds are essentially the money the secondary plan saves when acting in a secondary capacity.

It’s important to note that many states still enforce the establishment of benefit reserves for COB savings in state-licensed secondary plans. Therefore, it becomes crucial for dental providers to submit claims to secondary plans. By doing so, the secondary plan can determine the amount it would have paid if it were primary and allocate the saved money to the patient’s benefit reserve. These reserve funds can cover future claims, potentially alleviating deductibles and copayments the patient would otherwise have to pay out-of-pocket.

The presence of a benefit reserve can often result in secondary carriers paying more than expected on a claim. This additional coverage can extend up to 100% of allowable charges that the secondary plan would not typically cover. Thus, understanding the utilization of a benefit reserve can significantly benefit dental providers and their patients.

How the benefit reserve works

Mrs. Smith had a claim for osseous surgery for $1,800. Her primary plan paid $900, leaving her a balance of $900. The secondary plan received the claim and noted that its benefit would have been $1,260 if it were primary. Mrs. Smith’s secondary plan paid the remaining balance of $900 and deposited the $360 it saved as the secondary plan into Mrs. Smith’s “benefit reserve.”

Later that same year, Mrs. Smith received a bruxism appliance, which was a covered benefit of her primary plan but not her secondary plan. Her bill was $450. Her primary plan paid $225, and her secondary plan paid the remaining balance of $225 from her benefit reserve account.

Sample Explanation of Benefits (EOB)

The patient received a payment of $197.40 due to COB savings or benefits reserve. The provider of service received the remaining $48 of the benefit.

Conclusion

A benefit reserve is critical in dental insurance claims, particularly coordinating benefits scenarios. Dentists and dental team members should be aware of the concept and its implications to maximize coverage for their patients. By proactively understanding and utilizing benefit reserves, dental practices can provide enhanced financial support to their patients while ensuring proper reimbursement for their services.

©2024 Tidewater Consulting Services, LLC

Read More

Accurately reporting the treating doctors in dental practices is crucial for ensuring ethical billing practices and avoiding potential fraudulent activities. This article will discuss the risks associated with improper reporting and highlight the significance of following correct billing procedures.

Understanding the Risks

Improperly reporting the treating doctor can have serious consequences for dental practices. One potential risk is fraudulent billing, where practices misrepresent the treating doctor to receive higher reimbursement rates. This can lead to legal repercussions and damage the reputation of the practice. Additionally, improper reporting violates legal and regulatory requirements, which can result in investigations, penalties, and even loss of licensure.

How to Accurately Report Treating Doctors

To maintain integrity in billing practices, dental practices must adhere to accurate reporting of treating doctors on insurance claims. Let’s explore the proper procedures for reporting treating doctors in different scenarios.

When a new associate performs an oral evaluation, and the hygienist performs hygiene services, it is essential to accurately report the treating doctor. The doctor supervising the hygienist and performing the evaluation should be listed as the treating doctor for both services.

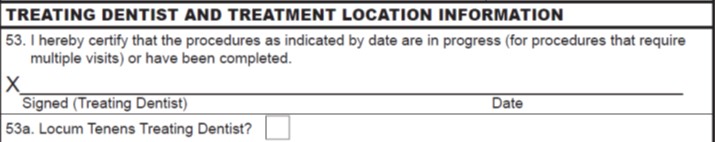

In the case of locum tenens doctors filling in for the owner doctor, it is essential to report the treating doctor accurately on the insurance claim. The name and National Provider Identifier (NPI) number of the locum tenens doctor who actually performs the treatment should be reported. The 2024 ADA Dental Claim Form, effective January 1, 2024 addresses how to more accurately disclose to the payer that the provider is a locum tenens. Read more about the 2024 ADA Claim Form changes.

When reporting treating doctors, it is important to be aware of any exceptions and guidelines provided by preferred provider organizations (PPOs). Some PPOs may allow the owner’s name and NPI on the claim form in specific circumstances. It is recommended to consult with dental payers and seek advice from a healthcare attorney for clarity.

Conclusion

Accurate reporting of treating doctors is essential for maintaining ethical and lawful billing practices in dental offices. By following correct procedures and seeking expert guidance, dental practices can ensure compliance, integrity, and fair reimbursement. Don’t risk your practice’s reputation and legal standing – report treating doctors accurately and ethically.

Guidance from the ADA regarding Locum Tenens

©2023 Tidewater Consulting Services, LLC

Read More

Creating seamless experiences for patients and dental practitioners is a top priority in the healthcare industry. And now, there’s exciting news for dental practices. Starting January 1, 2024, a revised version of the ADA Dental Claim Form will be in effect. This updated form specifically addresses the challenges faced when filing claims for services provided by locum tenens dentists. It incorporates additional features that streamline the reimbursement process while staying up-to-date with industry developments.

Solving the Locum Tenens Dentist Challenge:

The primary goal of the new 2024 ADA Dental Claim Form is to resolve a unique issue related to services provided by locum tenens dentists. These dentists temporarily fill in for others who may be away from their practice due to vacation, illness, or continuing education. Previously, filing claims for services provided by locum tenens dentists was complicated because there was no designated field to differentiate them from regular dentists. This resulted in a lengthy and burdensome reimbursement process. However, the updated 2024 ADA Dental Claim Form introduces a specific field to identify locum tenens providers. This simple addition eliminates confusion, improves accuracy, and speeds up claim adjudication and reimbursement.

Streamlining Claims Adjudication and Reimbursement:

The new 2024 ADA Dental Claim Form addresses the locum tenens challenge and provides dental providers with a more comprehensive way to report essential data. This enhanced version includes sections that capture specific details crucial for efficient claims processing.

Expediting Claims Adjudication and Reimbursement:

The new 2024 ADA Dental Claim Form tackles the locum tenens problem. It gives dental providers a more comprehensive and organized way to report essential data. This enhanced version includes sections that capture specific details crucial for the efficient processing of claims.

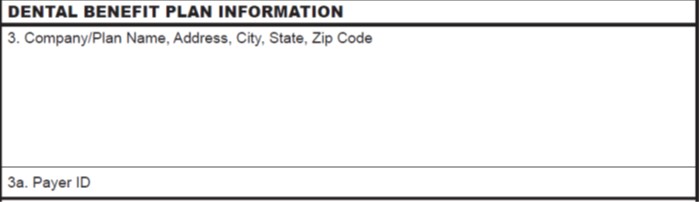

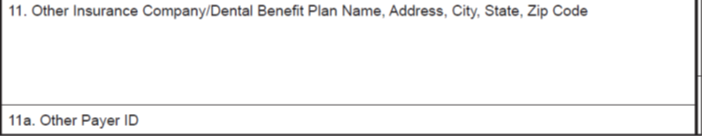

One such inclusion is the reporting of payer IDs. Payer IDs are national identifiers assigned to third-party payers, such as insurance companies. By capturing this information accurately, the claims processing system can effectively identify the appropriate payer, reducing errors and enabling expedited claim adjudication.

Additionally, the 2024 ADA Dental Claim Form includes a space to record the date of the last scaling and root planing (SRP), a common procedure requested by payers. By capturing this date, there is less need to request additional information from the provider, resulting in faster claim adjudication and reimbursement.

Adapting to Evolving Industry Standards:

As the dental insurance landscape evolves, claim forms must accurately reflect these changes. The 2024 ADA Dental Claim Form aligns with current dental industry standards, meeting the needs of practitioners and insurers. By introducing fields for locum tenens information and providing spaces for crucial identifiers like payer IDs and date of the last scaling and root planing (SRP), the form ensures seamless communication between dental practices and insurance providers.

In Conclusion:

The introduction of the 2024 ADA Dental Claim Form brings about a simpler, more efficient, and accurate claims process for dental providers and patients. With dedicated fields for identifying locum tenens dentists, reporting payer IDs, and recording the date of the last scaling and root planing (SRP), the aim is to expedite claim adjudication, minimize errors, and maximize reimbursement for dental practices. By continuously updating the form to reflect the evolving industry, the dental community demonstrates its commitment to utilizing technology and improving the overall experience for everyone involved.

Note: The ADA claim form is copyrighted by the American Dental Association.

©2023 Tidewater Consulting Services, LLC

Read More

Coordination of Benefits (COB) determines the order in which healthcare claims are paid, known as primary, secondary, tertiary, quaternary, etc. In some cases, a patient can have four plans – for example, a 24-year-old patient who is covered under her employer’s plan, spouse’s plan, father’s plan, and mother’s plan. The Affordable Care Act (ACA) allows dependents up to age 26 to be eligible for healthcare benefits under the parent’s plan, which is why some patients can be covered under multiple plans. While the ACA rule requirement to cover dependents up to the age of 26 is specific to health insurance plans, many employers include dental coverage to simplify the benefits package.

COB rules ensure that the total benefit paid does not exceed the total amount of fees billed, and it is important to determine the order of benefits prior to submitting any claims to prevent any overpayment. Each plan has its own established COB rules, but there are governing bodies that provide guidance. State laws apply to fully insured plans sold in that state, and these plans follow any established COB rules of the state in which the plan was sold. Self-funded or federal plans do not follow state insurance laws; they follow federal law or ERISA rules. This is where COB can be confusing because each plan establishes its own rules. It’s essential to understand each plan’s COB rules to ensure proper billing and avoid overpayment.

The National Association of Insurance Commissioners (NAIC) has published a recommended COB model, which most states have adopted as a guideline when establishing their rules, but there is no requirement to adopt these rules. Therefore, there is no clear standard that applies to all dental plans across the board. Some common NAIC recommended COB models when determining the order of benefits are the active employee or retired or laid-off employee, dependent children whose parents are divorced or separated, and COBRA or state continuation coverage.

There are several common COB models used to determine the order of benefits. For example, for a dependent child whose parents are divorced or separated, the order of benefits depends on whether a court decree assigns responsibility for the child’s healthcare expenses. If a court decree exists, the plan covering the parent with responsibility is the primary plan. If there is no court decree, the order of benefits is typically the plan covering the custodial parent, followed by the plan covering the spouse of the custodial parent, then the plan covering the non-custodial parent, and finally, the plan covering the spouse of the non-custodial parent.

COB is important because it prevents overpayment and ensures that the appropriate plan pays for the claim. Providers must determine the order of benefits to ensure that the claims are paid correctly. Understanding COB rules is important for providers and patients alike to avoid confusion and prevent overpayment.

Tidewater Dental Consulting offers a comprehensive hands-on workshop to ensure your team is properly processing claims and payments when multiple plans are involved. Often PPO adjustments are improperly calculated in COB scenarios resulting in loss of revenue for your practice. Contact us to learn more about our workshops.

Read More

The CMS final rule is here effective January 1, 2023 and I want to answer some common questions about how this might affect your practice.

Original Medicare provides benefits for treatment directly related to medical conditions. However, original Medicare has traditionally excluded all dental treatments unless the treatment is directly related to a covered medical condition which is published in the following statement:

Statement of exclusion (Code of Federal Regulations § 411.15 [section i])

“Dental services in connection with the care, treatment, filling, removal, or replacement of teeth, or structures directly supporting the teeth, except for inpatient hospital services in connection with such dental procedures when hospitalization is required because of –

(1) The individual’s underlying medical condition and clinical status; or

(2) The severity of the dental procedures. “

There are exceptions to these exclusions. Medicare has always permitted payment for some medically related procedures. For example:

- Treatment of fractured jaw, including any tooth necessary tooth extractions

- Extraction of teeth prior to radiation for head or neck cancer

- Dental examinations prior to kidney transplant or cardiac valve replacement

What has changed?

Effective January 1, 2023, an amendment to this regulation will specify “in order for Medicare payment to be made, the dental services must be inextricably linked to, and substantially related and integral to the clinical success of certain other covered medical services.”

This re-interpretation of the exclusion exceptions allows dentists to provide patients with much-needed dental care associated with specific surgical procedures.

What will be covered?

Expanded definition of benefits include:

“Dental or oral examinations, including treatment, performed as part of a comprehensive workup prior to organ transplant (including hematopoietic stem cell and bone marrow transplantations) or prior to cardiac valve replacement or valvuloplasty procedures.” The examination and/or treatment may be performed either inpatient or outpatient.

Before this new ruling, only the examination was covered (no treatment) and must be performed, inpatient. Also, until this revision, only kidney transplant was indicated for coverage—now, all organ transplant types are included.

Treatment is now defined to include the following:

- Extraction of teeth

- Removal of infection, including restorations of tooth structure (i.e., fillings) and periodontal treatment for infection (i.e., scaling and root planing)

Coverage is limited only to treatment immediately required to ensure a successful and safe transplant procedure. Additional services, such as a dental implant, crown, or future hygiene visits, may not be considered immediately necessary and will not be covered.

It is important to note that with this new ruling, some previous verbiage has been revised. For example, “wiring of teeth” will change to “stabilization.” In addition, it is anticipated that there will be additional verbiage changes, adding clarity for providers.

How does this new coverage rule affect dentists?

Dentists will be providing these covered services to Medicare beneficiaries on a more regular basis than ever before. So, what rules and regulations should a dentist be mindful of?

Covered services are subject to the mandatory filing requirement. The mandatory filing requirement has been in effect since September 1, 1990. There are exceptions to the mandatory filing rule – covered services provided free of charge are not required to be filed. So, you must either file a claim for the patient or provide the service for free.

What reimbursement can I expect? CMS has indicated the rate of reimbursement will be determined by the individual Medicare contractors.

CMS advises dentists to verify their enrollment status and determine whether any action is necessary.

Not sure how to determine your enrollment status? There are a couple of ways to determine your enrollment status.

- Contact your Medicare Administrative Contractor, commonly referred to as a MAC

- Use this link to access provider enrollment data

- Use this link to confirm your Opt-out status with Medicare

Medicare Enrollment

- A provider must be enrolled as a Part B provider of service to file for covered services under original Medicare.

- Enrollment as an order/referring provider does not allow filing claims and receiving reimbursement for covered services.

- Opted-out providers may not file claims to either original Medicare or medical coverage of Medicare Advantage plans. (Opted-out dentists are permitted to file claims to Medicare Advantage dental plans)

If you expect to file claims, enroll now as a Part B provider.

Opted-out dentists may continue to enter into private contracts with patients and treat patients on a self-pay basis. However, entering into a private contract is crucial as part of the opt-out agreement. Don’t’ overlook this essential requirement.

Medicare Advantage—how is it affected by the CMS final ruling

Medicare Advantage (MA) plans are required to provide medical benefits equal to or greater than Original Medicare. This will include medical benefits for the expanded coverage as outlined in the CMS final rule.

Previously, these services may have been covered under the MA dental plan. As a result, dentists could submit claims and receive payment regardless of enrollment status with Original Medicare.

It is important to note that opted-out providers are not permitted to receive reimbursement for medical services. Therefore, dentists currently opted out will continue to enter private contracts and provide medical services as self-pay for all services considered covered under original Medicare.

What’s in the future?

As research on the link between oral and physical health continues to grow, we expect all healthcare, including Medicare, to expand coverage for medically related dental coverage.

CMS continues to review and potentially revise its policy on dental coverage. In addition, they have stated that future Final Rulings may include coverage for other medically related dental treatments.

Your input matters! Recommendations are encouraged and should be submitted via email by February 10 of the calendar year 2023. The email is: MedicarePhysicianFeeSchedule@cms.hhs.gov

Recommendations and comments should include all clinical evidence to support the correlation between dental treatment and significant improvement in the quality and safety of patient outcomes.

Next Steps

You may be asking yourself, now what? First, confirm your enrollment or opt-out status with Medicare. Make an informed decision on Medicare enrollment. Educate your team on how your enrollment status and this final rule may affect your practice so that your team can effectively and accurately communicate with patients. Make no assumption that only patients aged 65 and over are Medicare beneficiaries. Medicare patients may be younger patients who are receiving social security disability benefits or have end-stage renal disease.

This new ruling is a step in the right direction in providing benefits for dental procedures related to certain medical conditions. This includes commercial and Medicare. Commercial payers tend to follow Medicare coverage criteria, so expect the need to submit medical claims to continue to increase. Attend one of our upcoming medical billing workshops to learn how to implement medical billing in your practice, or contact us to discuss how our consultation services can support your practice with this, and other important coding and billing questions.

Read More

Coding can be complex and challenging at times. It is not to be taken lightly. The three things dental teams should know about up front about coding are discussed in this article. It has been my experience that there is very little reliable education about coding for dentists and dental teams. So, I want to offer a starting point for your journey.

First, things first- Proper Coding Ensures Proper Reimbursement!

Coding is an area of compliance that is often overlooked in the dental practice. Documenting what we do and why we do it is crucial. A starting point is to understand the three overarching coding principles that apply to our profession.

Three Code Sets That May Apply to Dentistry

In dentistry the one code set dental teams are most familiar with is Current Dental Terminology known as CDT. CDT is the standard code set used to document dental procedures rendered to patients in a uniform fashion under the HIPAA act of 1996. CDT codes are also used to report procedures to third-party payers such as a dental or medical insurance plan for reimbursement consideration.

Sometimes, we find that dental procedures we perform in the dental practice are considered medical in nature and find it necessary to send a claim to a patient’s medical plan. These include procedures related to dental trauma, biopsies, sleep apnea appliances and much more.

When submitting procedures to a medical payer, a Current Procedural Terminology code, known as CPT® is used to report the procedure. Sometimes the CDT code is reported when there is no accurate CPT code available to describe the dental procedure performed. Coding guidelines are that the provider is to use the code that most accurately describes the procedure performed. Sometimes, this is the CDT code. It takes a little training time and practice – but your teams can learn when to use CPT and when to use CDT.

One important gem I can offer is that while a CDT code may be reported to medical payers when appropriate, a CPT code will never be reported to a dental payer.

Another standard transaction code set dental teams are not as familiar with is diagnosis codes. Diagnosis codes are utilized to establish medical necessity, the why. Why was the procedure required; what medical or dental condition are you treating? For many years in dentistry we have described why we perform procedures and what we do via narrative on a dental claim form. The good news is that we don’t have to narrate this anymore! The ICD-10 CM is the code set used by physicians, dentists and other healthcare providers to document and report diagnoses. It has been in effect since October 1, 2015. There are currently over 73,000 codes, so yes there is a code for that! Whatever the condition you’re treating there is a code to describe it.

Instead of attaching a lengthy word narrative to a dental claim we can utilize a diagnosis code in place of a narrative. This is a standard way of communicating the why of a patient encounter. And aids in adjudication or processing of the claim.

It’s not enough to know the three codes. Each of these codes have guidelines that must be followed with them. Possibly the most important reference is that anyone reading the patient’s record should be able to recognize the code used as documented and understand what services were delivered and why the services were necessary. Our documentation tells the story of the patient encounter. So, how do you do this efficiently and effectively as a practice? How do you know if all of your team knows how to tell the story?

Next Step

This can be challenging because all codes are reviewed and revised on an annual basis. Annual training of the entire team should be held prior to the effective date of the code, which is January 1 of each calendar year for CDT and CPT. ICD 10 code set is also updated on an annual basis however it becomes effective October 1 of each year instead of January 1. You don’t have to go it alone, we’re here to help!

Read More